Running out of Luck

Edition 8. Coffee with a side of fraud. Memes are dying faster

Imagine a rapidly developing Asian country where caffeine consumption per person has already reached the levels seen in developed economies like Japan and South Korea. Almost all of the caffeine consumption in this country is in the form of tea (~95%).

The chart below shows tea vs coffee consumption over time. The different lines belong to different countries.

Notice the yellow line. It shows that tea consumption in this country has risen rapidly as it got richer. Coffee (on the left) rose too, but nowhere as much as tea.

What would be your takeaways? You might think building a pure coffee brand in this tea-drinking country would be hard. Well, the founders of Luckin coffee believed otherwise about China.

They went about building a tech-focused coffee takeaway brand where users could only order and pay through their mobile phones. Over 4,500 stores were opened in two years, surpassing the stores that Starbucks had in the country.

Luckin reported a 6x increase in revenue in 2019 compared to 2018, raised investments from storied investors such as Singapore’s sovereign wealth fund and Blackrock among others, and eventually went public, listing on the NASDAQ stock exchange in New York in 2019. The founders did all this within 18 months of the company’s inception.

As of two weeks ago, they also became associated with the biggest fraud the Chinese start-up ecosystem has seen in a long time.

This is an incredulous tale, involving a cat and mouse game of a lying company and a dogged whistle-blower unleashing an incredible report (here is a good podcast that summarizes this well), and a once in a lifetime pandemic that ended it all.

It has implications on the start-up ecosystem not just in China but outside it as well. Let’s dig into that today.

How was the cover blown off?

There was a charming simplicity to it.

If a company’s stores claim to have a certain quantum of sales, I could observe the store traffic and make estimates if that number seems correct or not.

That is exactly what a research firm did. Over 1,500 people were hired to observe 600 stores at all times. They counted the footfalls and the number of items people were buying.

That’s it.

This incredibly simple exercise showed that the number of store items that Luckin was claiming to sell was inflated by 88% in Q42019. Yes, Luckin was claiming to have almost double the sales than it actually did.

There is a simple way in which companies get around this kind of fraud. They issue sequential receipts as sales happen. Put simply, in the morning, when person 1 places an order, a receipt is generated which shows 1. By the end of the day when the last person, 100, is placing an order, that receipt would show 100. Anyone wishing to determine the total orders can just check the number issued on receipts.

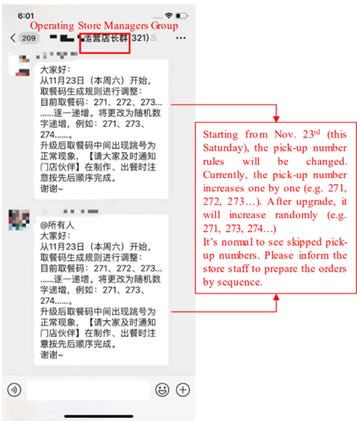

How do you get around it? You could just generate random numbers on the receipts. If that sounds too simple, well, that is what Luckin did. That would mean when person 1 placed an order in the morning, the receipt generated could very well have the number 50 printed on it.

Luckin sent this message to their store managers on their WeChat account.

Laughably simple in its effectiveness.

The research firm was not done yet. They collected over ~26,000 receipts from 10,000+ customers across 2,500 stores to understand how the business was doing, in the process uncovering some shocking facts.

Analysis of receipts also showed that Luckin’s claims of sales of ‘other non-coffee items’ on the menu were inflated by an eye-watering 400%.

It also showed that there were troubles in the core business model as well.

Typically, people order more items during online deliveries to reach the free delivery threshold than they do when they go to a store. As Luckin rapidly expanded across China, its delivery volume fell and people on average ordered fewer items per order thus depressing revenues.

Driven by the ‘growth at all cost’ mindset’, Luckin acquired customers by aggressively handing out generous coupons for discounted and free coffees. Consumers continued to rely on these coupons. As a result, even months after opening a store, the average selling price per order did not increase. What did Luckin do? As you would have figured by now, it lied and inflated its average price per order by 12% as well.

The overall impact of all of these meant that Luckin was operating deep in the red with store-level losses of 25 – 28% as opposed to their claims of store-level profitability.

Revenue – Expenses = Profit.

A simple business equation. More avenues for fraud. Now, Luckin was in a bind. The revenues were way too low compared to what they had claimed. Higher revenues would ideally lead to higher profits (assuming no increase in expenses). But Luckin had lied about its revenues, vastly overstating it. Investors would thus expect a higher profit. Do you get caught for the obvious discrepancy? Yes, except if you overstate your expenses.

You guessed it, Luckin did that too.

Analysis of data collected by a third-party media firm brought this discrepancy to light.

All of this allowed Luckin to put up a façade of a high growth model, attracting top investor dollars who did not care about profits as long as the company showed consistent metrics of growth. The house of cards was built.

Luckin gets cancelled as well

This façade might not have been unearthed if not for the COVID-19 outbreak. The massive business shock meant that there was no way this show could have continued. Revenues dried up completely and the house of cards collapsed. And collapse it did in a spectacular fashion with the company initiating proceedings against its COO for fabricating revenues. It’s share price nosedived and then the stock stopped trading at the NASDAQ.

The shockwaves of this collapse are affecting the broader ecosystem.

The fallout from Luckin Coffee Inc.’s accounting scandal is spreading far beyond the high-flying Starbucks challenger, with renewed concerns about Chinese corporate governance dragging down stocks across industries and threatening to bring a halt to the country’s overseas initial public offerings.

Other high growth firms with questionable business models are coming under the scanner. Some of the biggest backers of Luckin are pushing back fundraising plans.

At an ecosystem level, it threatens to cool down the investor mania of building fast and breaking things in the hopes of chasing ‘hockey stick’ growth. International investors went aggressive on China driven by a sense of FOMO. The likes of Masayoshi Son have built their legend on an investment in Alibaba, and no one wanted to miss out the next Alibaba. However, as the Oracle of Omaha, Warren Buffet quipped

Only when the tide goes out do you discover who's been swimming naked.

Faced with a moment of reckoning, it is inevitable that the investor ecosystem will be more thorough in its diligence and place a premium on real businesses building towards profits.

We are already seeing signs of it happen. Maybe the lasting legacy of COVID-19 will be a great moderation in growth mania. The start-up ecosystem will be better for it.

In other news

A few interesting things I came across this week.

This incredible interactive series by the New York Times detailing the photographs and transcripts of the famed Apollo 13 mission. There are some amazing tidbits here, like the fact that ground ops informed the astronauts in space that Beatles had decided to break up. And yes, when you read, ‘Houston, we’ve had a problem’, it still sends chills.

This was a serious meditation on one of the binding cultural milestones of the current generation - the meme culture. As people’s dependence on social media surges, memes face a faster ‘death’.

One of the things I have enjoyed since the lockdown is checking out some of the stunning places virtually. While not as satisfying as that #wanderlust photo, some of these are pretty incredible.

A few promising ones include this incredible drone footage of the stunning landscapes of Lesotho

This eruption of Mount Etna in Sicily is pretty spectacular too.

This story of a trip on Pamir highway that juts across Afghanistan, Uzbekistan, Tajikistan, and Kyrgyzstan had me gaping.

That is all for the current edition. If you like it, earn good karma by sharing it with others who might like it too. Feel free to send suggestions on twitter at @romit_ud or at romitnewsletter@gmail.com. Stay safe!