We have now spent months speculating on what the future might look like. It’s time to check up on that future.

Companies globally are releasing their earnings report which gives a ringside view on how the future is playing out. It’s popcorn worthy stuff really.

Okay, maybe that is just me. But reading these reports tells us so much about the Brave new (Economic) World that this newsletter has been trying to deconstruct.

If you think this will make someone else grab popcorn too, make their day - share the post with them!

Now let’s buckle in and check-in on a few major sectors in India and the USA today. As more companies announce their earnings, I will look at a few more sectors in next week’s edition.

Snack and wash your hands

William and James Lever, brothers, teamed up with a chemist in north England to start a company to produce soaps. They innovated in a staid category by using vegetable oils such as palm in their soaps instead of oil from beef and mutton fat as was the norm in the day.

In 1895, they introduced a bar of soap which landed on the docks of Bombay. In 1929, the Lever Brothers company merged with Margarine Unie – a Dutch company, to form Unilever. The soap which they had introduced? It was Lifebuoy.

In a rather interesting coincidence, another pair of siblings, also William and James, started a food company in Chicago in 1872. They held the patent for malt powder which added a distinctive flavor to the milk. Their product increased in popularity and by the second world war, soldiers were bringing it back to India as a dietary supplement. That is how India was introduced to the eponymous product of James and William Horlicks.

Two brands, storied history, and today the saviour of the largest FMCG company in India - Hindustan Unilever Limited (HUL).

As COVID-19 shuttered the economy, personal snacking and hygiene products took off. HUL reported ~$1.5B in revenues (7% increase) and ~$251M in profits (~4.2% increase). Without Horlicks, the revenues would have declined by 7% instead. Health, hygiene and nutrition which makes up 80% of the portfolio, grew 6% (LifeBuoy too posted double-digit growth) while discretionary items sales declined by 45% (home care, beauty etc.).

HUL is not alone. Britannia’s sales rose at the fastest pace in eight years. It’s profit increased by 100% to ~$69M while the sales grew by 25% to ~$440M. FMCG segment of ITC has outperformed too, registering double-digit growth even as the company struggled given the reliance on hotels and cigarettes which were impacted during the lockdown.

Why?

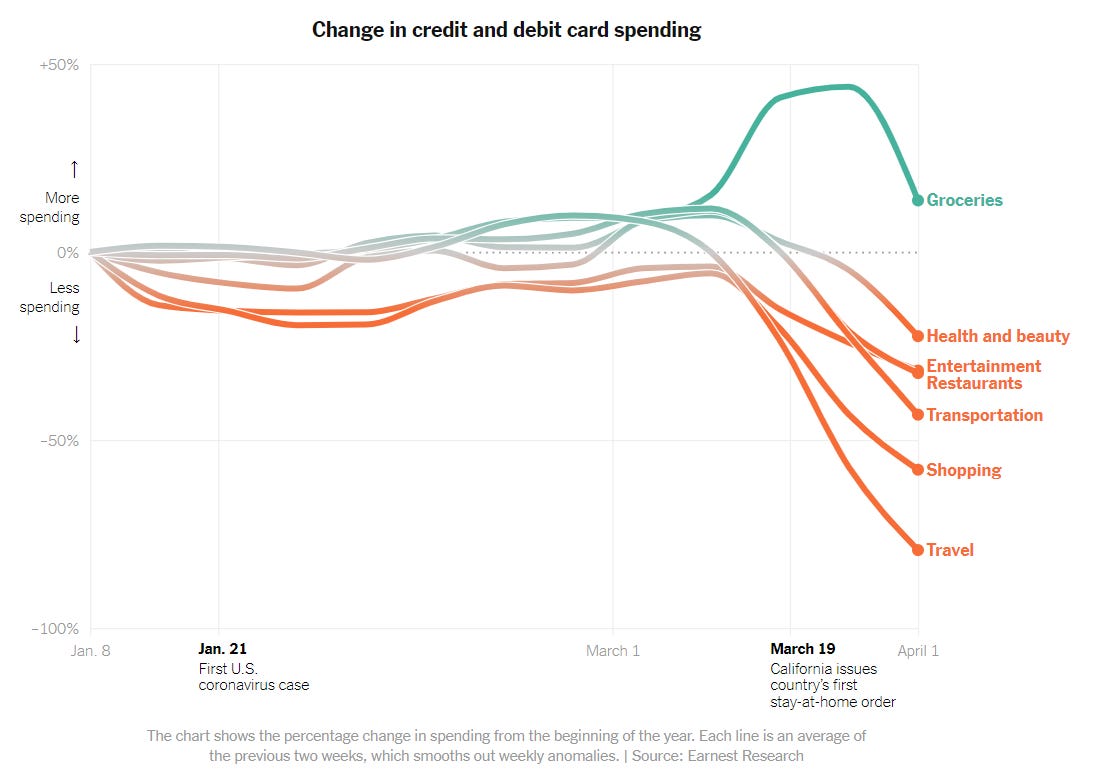

With restaurants inaccessible and only essentials permitted during large stretches of the lockdown in India, customers loaded up on groceries. This was not an Indian phenomenon. From the NYT -

HUL is now going deeper into hygiene products and also introducing ‘immunity boosting version’ of Horlicks. Expect more such innovation in categories that have seen little of it in many years. The sustained growth of many FMCG majors now depends on it. For example, Dabur, another FMCG major, has already introduced a new line of sanitizers including a few in interesting flavors such as this (which I recommend – it smells deliciously citrusy).

The oversold promise of organized retail

There is a common story that goes in investor decks for organized retail in India. It pegs the current penetration of organized retail at <10% of the total market of ~$900B of which grocery is ~$450B. However, organized retail is shown to be on the verge of hockey stick growth, disrupting the neighbourhood Kirana - the existing lifeblood of Indian commerce.

Yet the lockdown proved to be a moment when the Kirana shone brightly. An anecdote about the resilience of Vikas Bhagwani - a Kirana store owner in Delhi -

Typically, neighbourhood kirana stores are serviced by distributors of household goods makers who send over their sales teams to take orders and fulfil them. But as India entered the lockdown phase on 25 March, movement of distributors became infrequent, the Kirana stores too grappled with a shortage of labour and restrictions in vehicle movement.

This is why, beginning every morning at 6, Bhagwani travels all over Delhi to collect goods from distributors’ godowns

On the other hand, battered by the lockdown, organized retail chains have struggled. The results of DMart (Avenue Supermarts Ltd.) bear this out. DMart operates 216 stores across 11 states in India and is the poster child for efficient organized retail in the country. It decided to go public in March 2017. The offer price was 299/share, it listed on the stock exchange at over INR 600/share and the price had increased 4x from those levels by February 2020.

While the stock stayed resilient in the hope that the sale of essentials would tide the company over the COVID-19 hump, the reality panned out differently.

The quarter ending June was a forgettable one for DMart. The total revenues were ~$517M, a third lower than in the same quarter in the previous year. The net profits fell by a whopping 88% at ~$5.3M.

While the pain was expected, the extent of it surprised analysts and the sector alike. Despite many stores stuttered due to lockdowns, the costs were still high due to the constant need for sanitization and staff pay. And when the stores were open, the essentials shopping surge did not materialize.

Unlike developed countries where organized retailers had a surge of customers walking into their stores, it has not happened with the same intensity at our stores

- Neville Noronha, CEO - Avenue Supermarts

Who captured that surge in India? Most likely the Kiranas who have reported new customers coming to the stores during the lockdown.

The organized physical retail sector is in the throes of a crisis in India. COVID laid the dreams of a large incumbent, the Future Group, to rest. Riddled with debt and with a steep decline in revenue, it is now looking for a buyer. Reliance is reportedly in an advanced stage to snap up the business effectively turning organized physical retail into a two-horse race. Even in this two-horse race, the vector for differentiation is likely going to be non-grocery led.

Neighbourhood Kirana provides convenience, credit, and service based on years of earned trust. An online grocery outlet provides wide selection, competitive prices, digital payment and doorstep delivery. What exactly does a large organized retailer provide in the grocery segment outside of what is already provided by the other two avenues? That is the answer they would want to find to stay relevant.

For now, the Indian Kirana marches on, increasingly digitally-enabled as the likes of Dunzo, Swiggy and Jio train their eyes on them and VC investments pour in.

The banks are alright

The recession of 2008 started as a banking crisis. As the housing market collapsed in the USA, banks with exposure to the mortgage-backed securities were in trouble. The contagion spread as interbank lending screeched to a halt as no one was sure which bank could fall after Lehman Brothers. The pain of Wall Street infected Main Street, not just in the USA but across the pond in Europe as well and the global economy came apart.

On the other hand, the Great Infection has been splendid for the large banks in the USA. The crash of the stock market and the subsequent rebound aided by the actions of the central bank has led to bumper profits for the trading division of banks. Meanwhile, investment banking divisions have done well in earning fees as companies contracted them to help raise debt during the worst days of the crisis.

As a result, the industry has declared bumper profits.

JP Morgan, USA’s largest bank by assets, declared a blockbuster quarter. Revenue was 10% higher than estimated, coming in at ~$33B with ~$4.7B in earnings. Bond and equity trading revenue jumped by ~80% to $10B which handily made up for the loss posted by the retail banking division (~$176M in loss compared to $4.2B in profit last year same quarter).

However, the scale of losses of the retail banking division warns us about the pain in the real world. Wells Fargo, a behemoth with relatively modest investment division and focused mainly on traditional banking functions (taking deposits and giving loans), announced a terrible quarter. It clocked $2.4B in losses compared to $6.2 in profit the same quarter the previous year mainly on account of increased provision to cover for loans that are likely to go bad and reduced interest margins due to rate cuts by the central bank.

The four biggest American banks— JPMorgan Chase & Co., Citigroup, Bank of America Corp. and Wells Fargo & Co.—set aside $33 billion in the second quarter to cover loans that could go bad. Corporate lending accounted for $16.8 billion of it, up from $8.8 billion in the first quarter .

The pandemic which started with a hit to demand by consumers stopping purchases has unsurprisingly impacted businesses. Banks are expecting business loans to go bad and are preparing for it. Yet, so strong has been the impact of trading profits that despite putting aside large sums of money, that their capital adequacy ratios (indicating the ability to withstand financial shocks) have actually improved by 0.7% during the pandemic hit quarter.

There is something comically evil in the pop discourse of large banks. Fat profits for them in times of general bleakness roil many. The crisis has inflicted pain on most sectors. Banking does not appear to be one of those. Given that finance greases the global economy, allowing it to function, the health of banks is one of the few bright spots in an otherwise gloomy year.

What’s happening with Netflix?

The first six months of 2020 have been a boon for the streaming services.

Disney+ has racked up 50 million subscribers globally, a number that took Netflix seven years to hit. New services are being launched. After HBO, NBC launched its own streaming service which is also experiencing a strong initial uptake. Consumers are flooded with choices and they have shown a willingness to spend on the category. From the NYT -

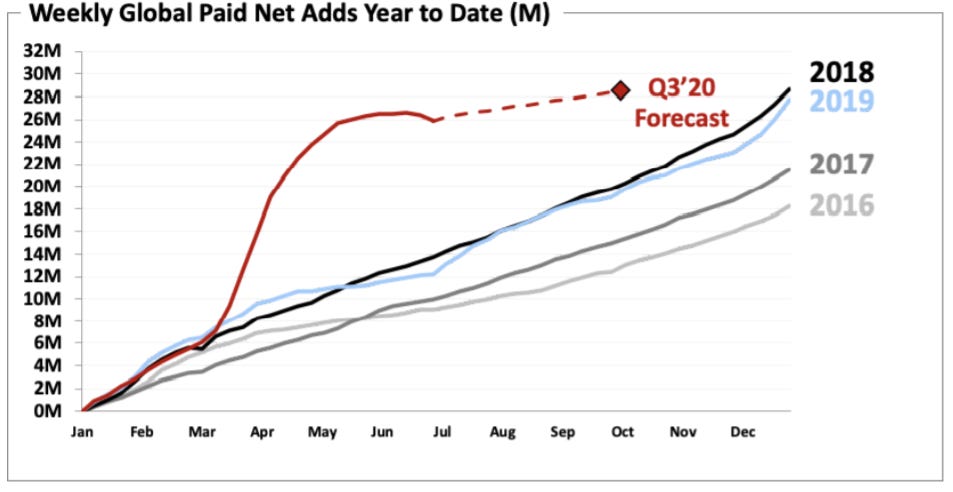

The bellwether of the industry - Netflix announced its earnings last week. It added 10 million new subscribers on top of the ~16 million already added in the quarter ending March. Netflix has already added almost the same number of subscribers in the first six months of 2020 as it did in all of 2019. Given that most of this growth is driven by international markets (since the US is already heavily penetrated), it is an impressive feat.

Revenue increased by 25% compared to last year rising to $6.15B. Due to national shutdowns, the content cost also decreased and now the company expects to turn a profit this year instead of burning ~$1B as earlier estimated.

This should be fantastic, right?

Turns out, not so much.

Netflix also presented this chart which freaked the investors out who punished the stock, its price falling by 10% on the day of the announcement.

Netflix estimated that it would only add 2.5 million new subscribers in the coming quarter compared to 6.8 million added last year.

Why?

We’re expecting paid net adds will be down year over year in the second half as our strong first half performance likely pulled forward some demand from the second half of the year. In addition, Q3’19 included the positive impact of new seasons of both Stranger Things and La Casa de Papel (aka Money Heist).

So more people who were on the edge signed up and the number of people on the edge would now naturally be lower who would convert to paid subscribers of the service.

I personally think the stock market reaction was overdone. By all accounts, COVID-19 has created a generational shift towards streaming. People are streaming more and most intend to continue this habit.

In a competitive landscape with multiple services targeting this new customer behaviour, Netflix has out-executed the rest. Shorn of a deep library of legacy content like many of its competitors, Netflix has turned into among the most innovative media production houses spotting opportunities that others miss. Consumers have rewarded it by being loyal to it.

In essence, it is a must-have service and the customer is now effectively making the choice of Netflix and *another service* and not Netflix or *another service*.

No doubt, this is aided by increasingly sticky content. Extraction, the Chris Hemsworth starrer and a Netflix original, was streamed by 99 million households. Assuming 1.5 people per household (given many watch Netflix alone), at $10/ticket, this would have been a $1.5B grossing blockbuster. Yes, this is not a perfect comparison since the movie was effectively ‘bundled’ with the subscription, but the point still holds about the scale of the service and popularity of its content including the low brow ones such as Too Hot to Handle and Love is Blind.

As more of these shows and movies permeate pop culture, over time more people on the edge will convert to the service. As drivers of future growth, international markets are the key, explaining shows such as Indian Matchmaking.

Other services have the gauntlet thrown in front of them to ride the wave of once in a generation customer shift. They will need strong execution, content and a whole lot of luck.

In other news

For long the core belief in Macroeconomics was that the government should not spend indiscriminately to avoid inflation. With interests rates at a record low, central banks willing to print money and an era of low inflation, that rule-book has now been junked. What happens in a world where the government can spend as it pleases? I recommend this masterful piece in the Economist on how the pandemic is changing economics forever.

It is probably safe to say that 2020 has been an all-around terrible year. Yet, it is unlikely to get as gloomy as 536 AD - the worst year in recorded human history. Small mercies.

Netflix published the list of 10 most popular original movies on the site. How many have you watched?

Do you have a hard time understanding graphs on a log scale? Don’t worry, almost no one else does either.

This beautiful piece by a writer who took a train across Italy to understand how the country has changed after the pandemic.

That’s all for the week. If you enjoyed the post, do share it! The encouragement keeps me going. Write to me at romitnewsletter@gmail.com, Twitter or leave a comment. Stay safe!