An underappreciated fact in the current narrative is how close we were in March to a total collapse of the global financial system. I had covered in an earlier post how the global financial system was saved.

Yet, it is worth repeating that so dire was the situation that even Apple was having a hard time raising debt at an affordable rate of interest as the global demand collapsed. It took extraordinary efforts from the Central Bank of the US (Federal Reserve) to save the global financial order and the corporate debt market. Jerome Powell, the Chairman of the Federal Reserve, emerged as a hero.

Apart from the actions of the central banks globally who moved in to support their economies, governments also increased their spending to support households and businesses.

While developed countries like the USA can rely on the Federal Reserve to print money and inject that in the economy, most developing countries do not have this luxury.

Why?

They lack credibility in the eyes of the international finance community who fear that excess printing might lead to runaway inflation.

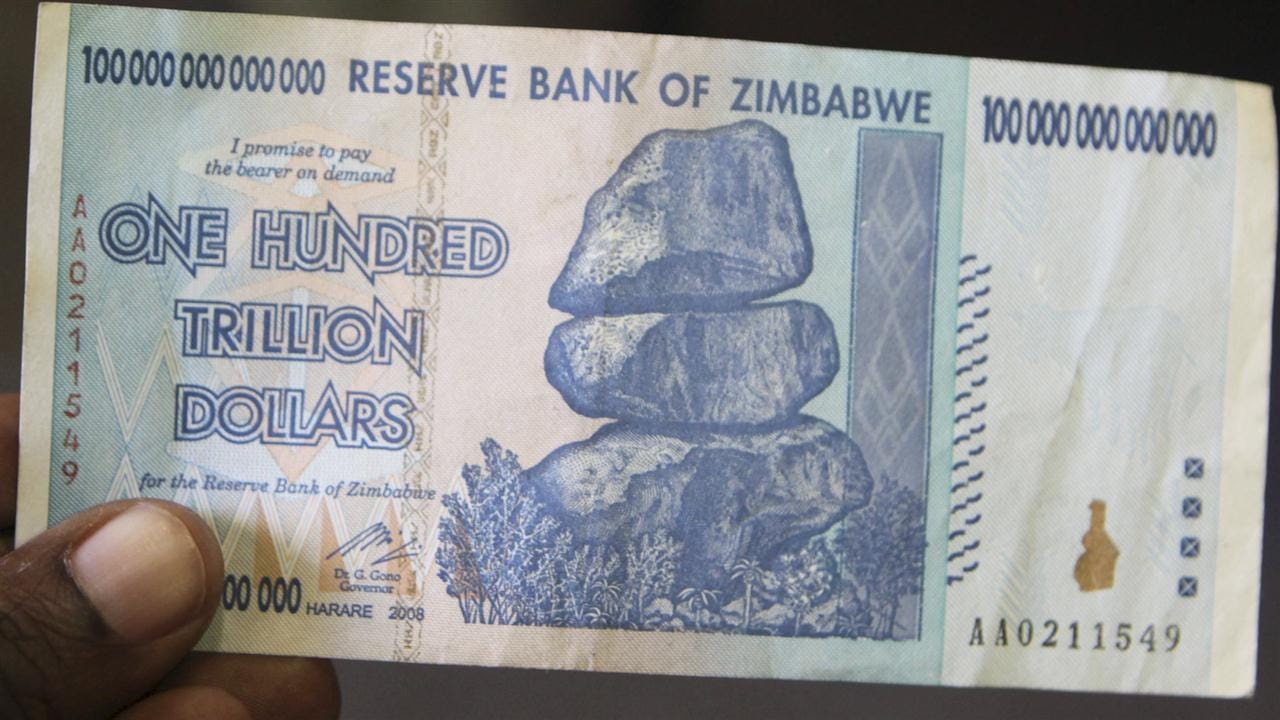

Zimbabwe’s central bank liberally printed money in response to shrinking government revenue as the mismanagement of the economy mounted in the 2000s. This led to levels of inflation unheard of in modern economic history. At its peak, prices rose by 79.6 billion% (yes, Billion) over a month in 2008. The currency became worthless and the famous *one hundred trillion Zimbabwe dollar* note was printed.

The entire event was so unnatural that this note can now be bought on Amazon. (Costs less than US$100).

So, printing money is not really an option. There are two other ways for the government to raise money - Taxes and Borrowing. In an economic crisis like the one right now, raising taxes would be suicidal for any government (apart from being a terrible economic policy) leaving borrowing as the only credible option.

Increasingly, governments in the developing world have tapped international markets to raise funds. International investors lent money to get higher returns and in the belief that the emerging economies were poised for rapid growth, keeping their investments secure.

What happens when a once in a century pandemic completely changes that calculus?

Let’s look at the arcane world of international sovereign debt today to discover national governments fighting for legitimacy, cowboy hedge fund managers holding out for the last dollar, calculations of a new world power, and the dire impact on the lives of millions of people living in these countries.

If you think someone would like this post, why not share it with them?

Rise of international debt

In the 90s, two Nobel winning economists joined a seasoned investor to start a hedge fund (Long Term Capital Management) that invested in multiple asset classes including government debt. Based on the insight of the economists, LTCM touted a new way to value assets. They took on excessive debt to invest further in an attempt to further boost their returns. Initially, the strategy was successful and LTCM delivered outsized returns to its stakeholders.

Then 1998 hit and things turned dire. The fund owned a substantial portion of Russian debt in the belief that the post-Soviet economic model would lead the country to riches. The script turned out to be different; the economy crashed and Russia defaulted on its debt. LTCM despite the default continued to stay invested as its models showed that it was the right decision. It clearly was not and the losses mounted and reached ~$4B.

LTCM had borrowed over ~$120B and a run on the hedge fund could have sparked a global financial crisis. The Federal Reserve eventually stepped in and authorized a ~$3.6B debt bailout of the fund to enable it to survive the crisis and wind up in an orderly manner.

The incident highlights the game of cloaks and daggers that investors and government might play operating in the sovereign debt market.

A major shift in the sovereign debt market over the past decade has been the rise of private investors. Traditionally, actors like LTCM were anomalies and the debt was owned by the likes of the World Bank and other Governments. However, that is not the case today. From the WSJ -

COVID-19 has caused the sharpest economic downturn since the Great Depression in the 1930s. As tax revenues shrink, commodity prices collapse, and exports slump, the ability of Governments to service this debt is under serious pressure.

Take the case of Zambia - once a darling of foreign investors. Copper’s (Zambia’s major export) price boomed from 2010 onwards driven by the demand from China. Rolling with the good times, Zambia decided to raise foreign debt in US dollars in 2012. As the story almost always goes, the good times did not last. The Chinese economy slowed down and so did their demand for copper.

Now the coronavirus has gripped the economy. In October 2019, the economy was expected to grow at 2%; now it is expected to contract by 5%. As a result, the investors have fled the country and the exchange rate has deteriorated. The government needed 14 Kwacha (Zambian currency) to pay back a dollar in debt, now it needs 19. Since exports have collapsed, this needs to be raised within the country.

As per the World Food Program, more than a third of the population in Zambia faces hunger and the country needs rapid investments to scale medical facilities to cope with the rising COVID-19 cases. Yet, the country’s debt obligations mean that critical resources are being spent to pay back the debtholders than meet its humanitarian needs.

The trouble is further exacerbated by the moves of another rising superpower – China. Zambia also borrowed liberally from China which has invested heavily in the continent to expand its strategic footprint. It was estimated that countries in Africa and state-owned companies have raised $145B from China between 2000 and 2017.

The problem is not limited to Africa alone. Tourism dependent Maldives borrowed liberally from China starting in 2014. It currently estimates that it owes ~$3B to China. To place that in context, the total GDP of Maldives is ~$5B.

Now, both Zambia and Maldives among many other countries are staring at a default. The IMF claims that over 40 countries have requested the suspension of debt payment.

Slow Burn

The crisis has been building for years. As the central banks of developed countries slashed their interest rates in the wake of the 2008 crisis, investors looked for higher returns in international markets. Emerging markets with the promise of high growth and high return seemed like attractive opportunities. The developing countries too lapped up the chance to raise debt for additional spending at historically low rates. For example, Zambia paid a lower rate on its debt issued in 2012 than Spain - a country 15X richer than it in terms of GDP per capita.

As these debts have piled up, defaulting on them is costly for countries. A default leads to credit rating agencies lowering their investment recommendations for the countries. This in turn leads to countries paying a higher rate of interest to issue new debt. As more resources are geared towards paying off debt, investments in critical areas such as infrastructure, healthcare, education, welfare are severely impacted creating an effective poverty trap.

The Western governments and the World Bank, still sizeable holders of these bonds, in the past have taken unilateral action by suspending debt payment. Doing so today would mean that countries could use that saved money to pay out China and private investors instead - an odious outcome in the current geopolitical climate.

The stakes are high. The IMF and G-20 have issued an open call to investors to come to the negotiating table to help lower the debt burden by reducing the rate of interest and making the payment terms more generous by increasing the tenor and giving moratoriums.

Hedge funds, however, have an incentive to not comply and be a ‘vulture’. Imagine this being a game of chicken. If you continue to insist on full payment while most of the other creditors agree to suspend debt payment, the governments will often pay you out in full to close the deal and make the nuisance go away.

Jay Newman, an erstwhile hedge fund manager at Elliott Management, created history by getting the full settlement from Argentina after a decade long battle. Other hedge funds have naturally copied the playbook.

Here is Jay Newman advocating investments in Venezuela in 2018.

In the face of international sanctions, Venezuela defaulted on its debt last year.

The negotiations are still ongoing but it is imperative that a settlement is reached soon. As Joseph Stiglitz, the Nobel winning economist, put it -

A global debt crisis today will push millions of people into unemployment and fuel instability and violence around the world. Many will seek jobs abroad, potentially overwhelming border-control and immigration systems in Europe and North America. Another costly migration crisis will divert attention away from the urgent need to address climate change.

The last thing we need is the health crisis which has turned into an economic crisis to turn into a sovereign default crisis. The welfare of millions depends on it.

In other news

Lebanon has been in the news for the last few weeks. The country’s economy was in ruins; it defaulted on its debt obligations earlier this year and suffered a horrific blast due to administrative mismanagement. Here is a gripping documentary on probably the most twisted civil war of the 20th century that gripped the nation in the 1970s, the aftermaths of which still shape the country today.

Carlos Ghosn, the disgraced ex-Chairman of Nissan and Renault, executed an escape from prison in Tokyo so daring that it might be considered too far fetched as a plotline in a movie. Here is how he did it.

The Parsis, coming as refugees to escape the persecution in Iran, reshaped India and Bombay with their contribution. The community is also rapidly dwindling. Shaun Walker goes back to his roots after his grandfather died to understand what we are losing as that plays out. The last of the Zoroastrians

That’s all for the week. If you enjoyed the post, do share it! The encouragement keeps me going. Write to me at romitnewsletter@gmail.com, Twitter, or leave a comment. Stay safe!